According to the National Association of Manufacturers, U.S. manufacturers produce 12.2 percent of U.S. gross domestic product, equating to $1.8 trillion annually. Manufacturing tends to be more capital-intensive, meaning the industry requires more assets to deliver its goods and services. Therefore, manufacturers generally have fixed asset-laden balance sheets and often have corresponding mortgages and loans. We also have clients that are “financial sponsors,” including private equity firms. There is no shortage of PEs that are looking to acquire (typically at least a majority interest) of manufacturers in certain industries.

- With solutions like HashMicro, businesses can automate key processes, reduce errors, and enhance their overall financial management.

- Most people understand that manufacturing financial statements provide an essential snapshot of a company’s financial health.

- The amount of taxes is deducted from the net profit to arrive at the bottom line, i.E., The net profit after tax.

- Therefore, as short-term liabilities, manufacturing firms often show one or more lines of credit used to fund the purchase of raw materials and working capital.

- We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

- That’s because a company has to pay for all the things it owns (assets) by either borrowing money (taking on liabilities) or taking it from investors (issuing shareholder equity).

8 Income Statements for Manufacturing Companies

And, it is not coincidence that higher multiples come down the pike when a company’s EBIDTA is higher. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for accounting for derivatives definition, example teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

How Can Asset Tracking Revolutionize Your Business Efficiency?

Over-allocation occurs when estimated overhead exceeds actual expenses, while under-allocation happens when actual costs surpass projected figures. Moreover, precise financial statements empower manufacturers to adapt their strategies in response to fluctuating market conditions. For internal stakeholders, such as managers and accountants, these statements serve as benchmarks for performance, support budget management, and assist in creating accurate forecasts. This balance sheet compares the financial position of the company as of September 2020 to the financial position of the company from the year prior. HBS Online’s CORe and CLIMB programs require the completion of a brief application. The applications vary slightly, but all ask for some personal background information.

Which of these is most important for your financial advisor to have?

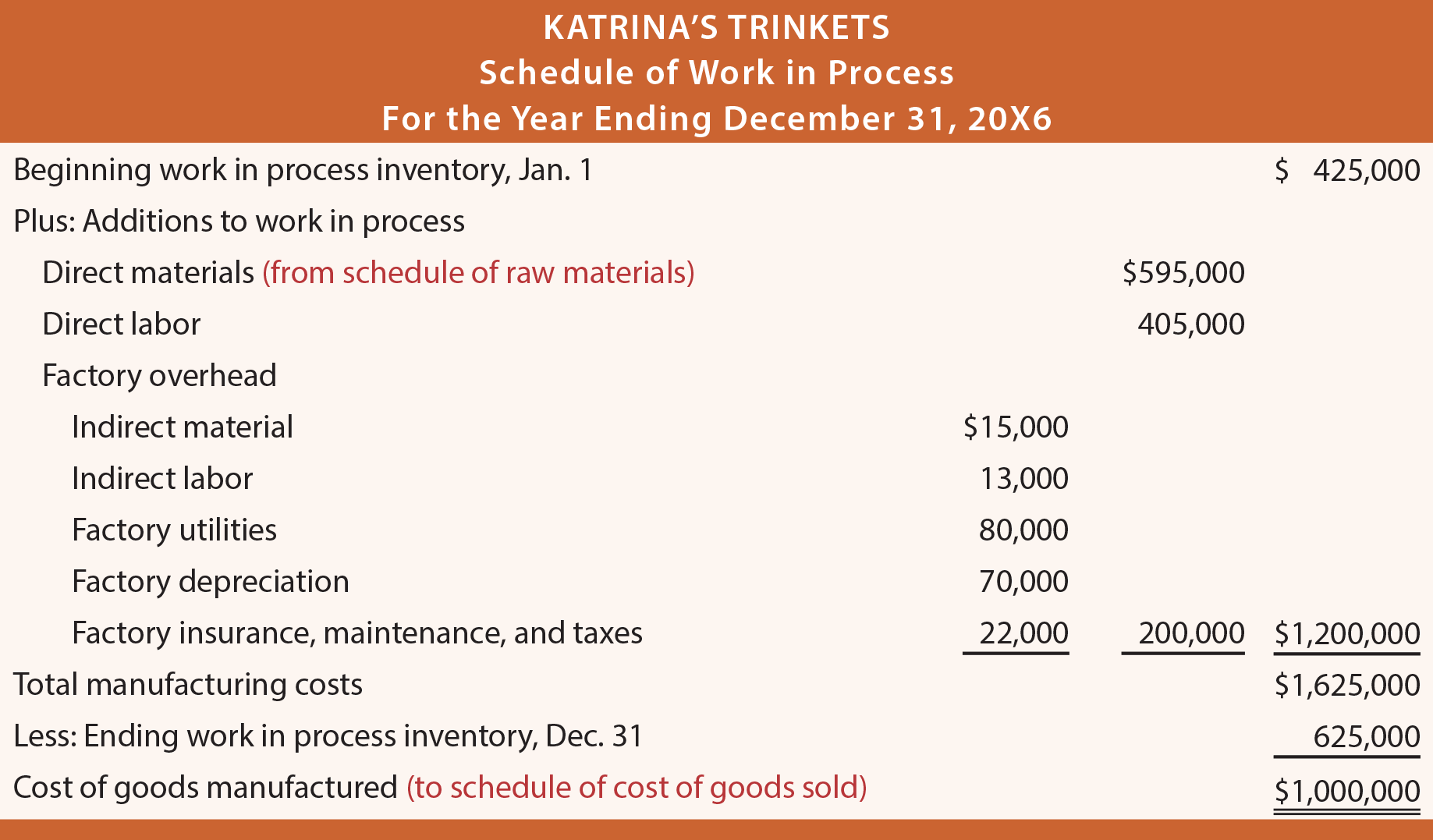

All programs require the completion of a brief online enrollment form before payment. If you are new to HBS Online, you will be required to set up an account before enrolling in the program of your choice. To prove the point suppose that Altec Corporation calculated total depreciation of $500,000 for 20X1. $300,000 of this depreciation pertained to the manufacturing plant, and $200,000 related to the corporate offices. Of the goods entered into production assume that one third remains in production, one third is finished awaiting resale, and one third was completed and sold. This results in the $300,000 of factory depreciation being allocated evenly to work in process inventory, finished goods inventory, and cost of goods sold.

The schedules of raw materials and work in process are often combined into a single schedule of cost of goods manufactured. This schedule contains no new information from that presented in the prior two schedules; it is just a combination and slight rearrangement of the separate schedules. Investors, creditors, and internal management use the balance sheet to evaluate how the company is growing, financing its operations, and distributing to its owners. It will also show the if the company is funding its operations with profits or debt. Now that the balance sheet is prepared and the beginning and ending cash balances are calculated, the statement of cash flows can be prepared. A manufacturing company reports taxes as a separate item in the income statement after the net profit.

What is the approximate value of your cash savings and other investments?

All of the supporting schedules that were presented leading up to the income statement are ordinarily “internal use only” type documents. The details are rarely needed by external financial statement users who focus on the income statement. In fact, some trade secrets could be lost by publicly revealing the level of detail found in the schedules. For example, a competitor may be curious to know the labor cost incurred in producing a product, or a customer may think that the finished product price is too high relative to the raw material cost. When the balance sheet is prepared, the liabilities section is presented first and the owners’ equity section is presented later.

Including non-operating expenses or misclassifying income can distort the company’s liquidity profile. External stakeholders, including investors and lenders, rely on these reports to evaluate profitability, liquidity, net worth, and solvency. These statements typically include details about various inventory types, such as raw materials, work-in-progress, and finished goods.

Just as assets are categorized as current or noncurrent, liabilities are categorized as current liabilities or noncurrent liabilities. External auditors, on the other hand, might use a balance sheet to ensure a company is complying with any reporting laws it’s subject to. Here’s everything you need to know about understanding a balance sheet, including what it is, the information it contains, why it’s so important, and the underlying mechanics of how it works. These statements not only serve as compliance tools but also unveil critical insights that can inform strategic decisions and enhance profitability. Calculating WIP can be particularly complex, as it is not as straightforward as evaluating finished goods. Nevertheless, WIP is a critical component of a manufacturer’s balance sheet, providing stakeholders with insights into productivity and operational efficiency.